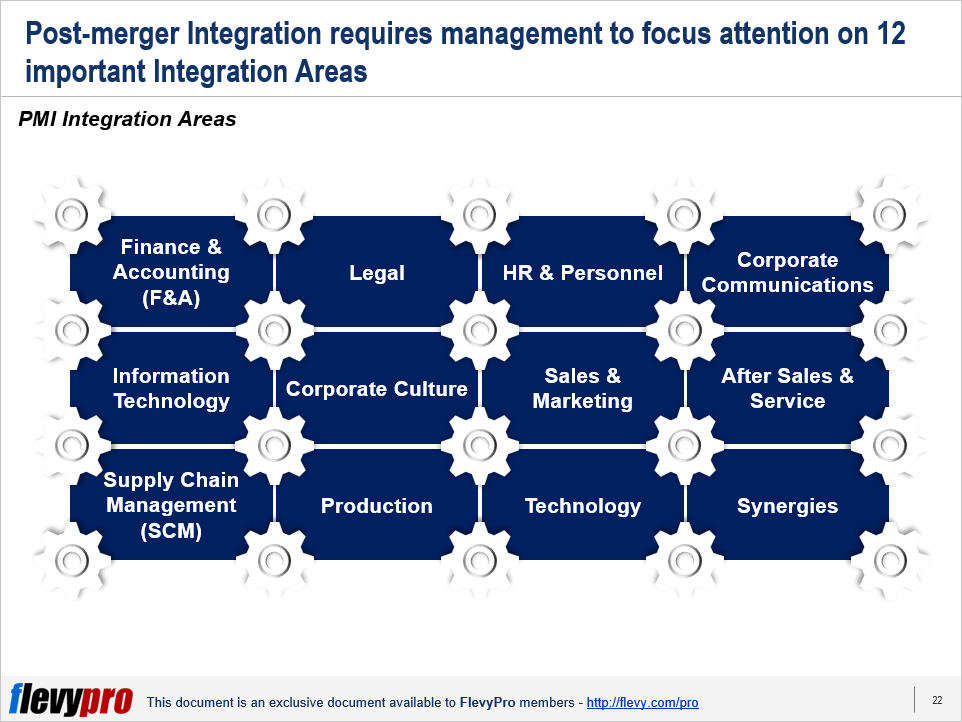

The 12 Areas of Postmerger Integration (PMI) Your Guide to Starting PMI the Right Way flevy

Creating a Post Merger Integration Checklist. When two companies decide to become one, the process doesn't end at signing the deal. That's where post-merger integration (PMI) steps in. It's like arranging a dance between elephants - you've got these large organizations with their own cultures and systems trying to move gracefully together.

PostMerger Integration M&A Integration Process Guide (2023)

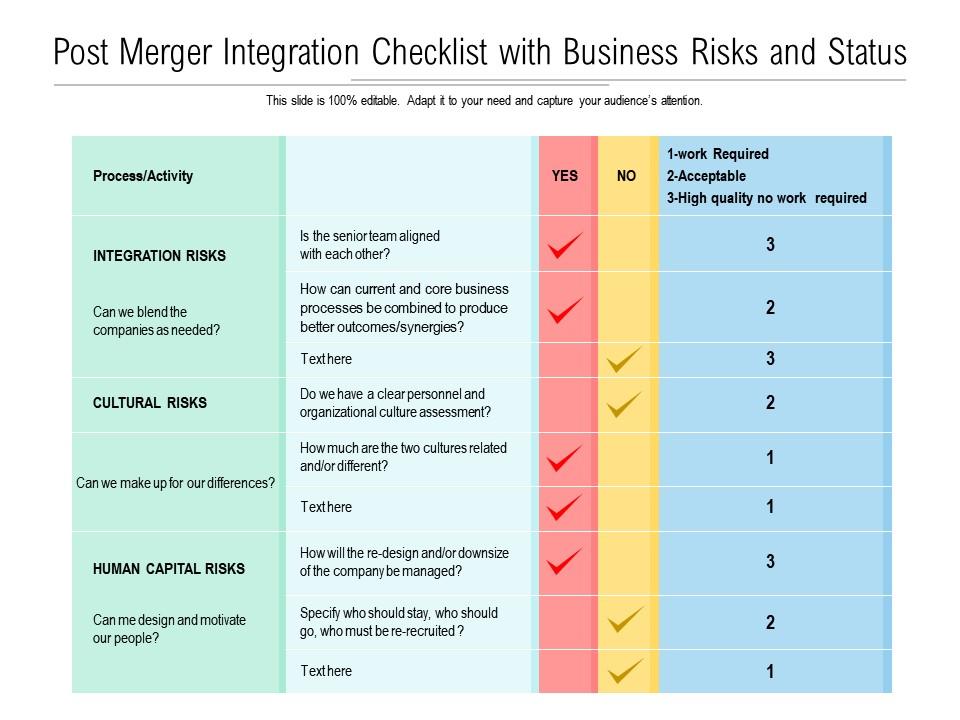

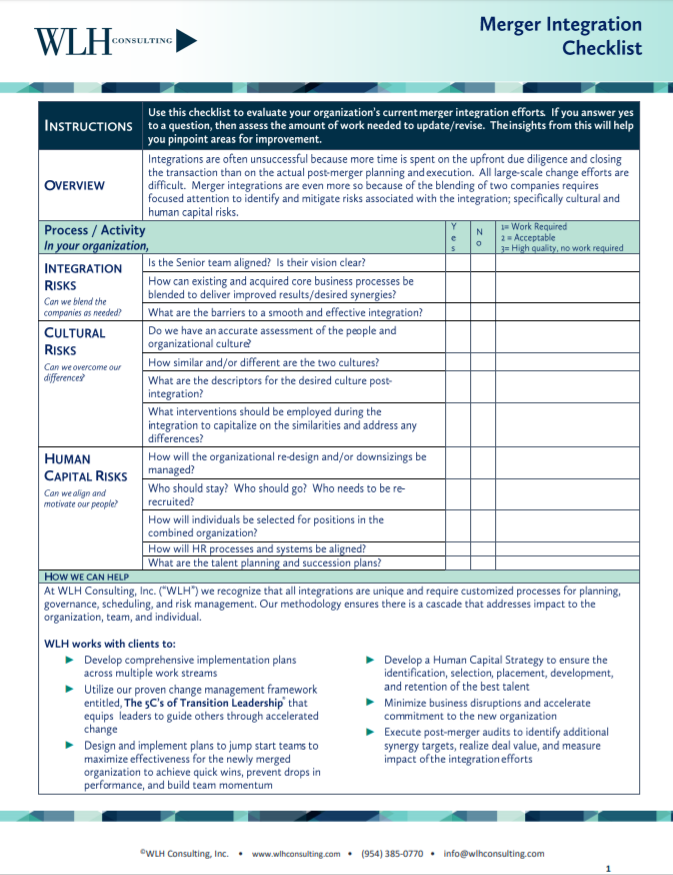

A post-merger integration checklist is a document that you can keep on file during a merger or acquisition that details all of the steps you need to take to ensure that you integrate the two teams in the best way possible. By integrating both teams and creating a new, stronger one, your business will hopefully receive a boost.

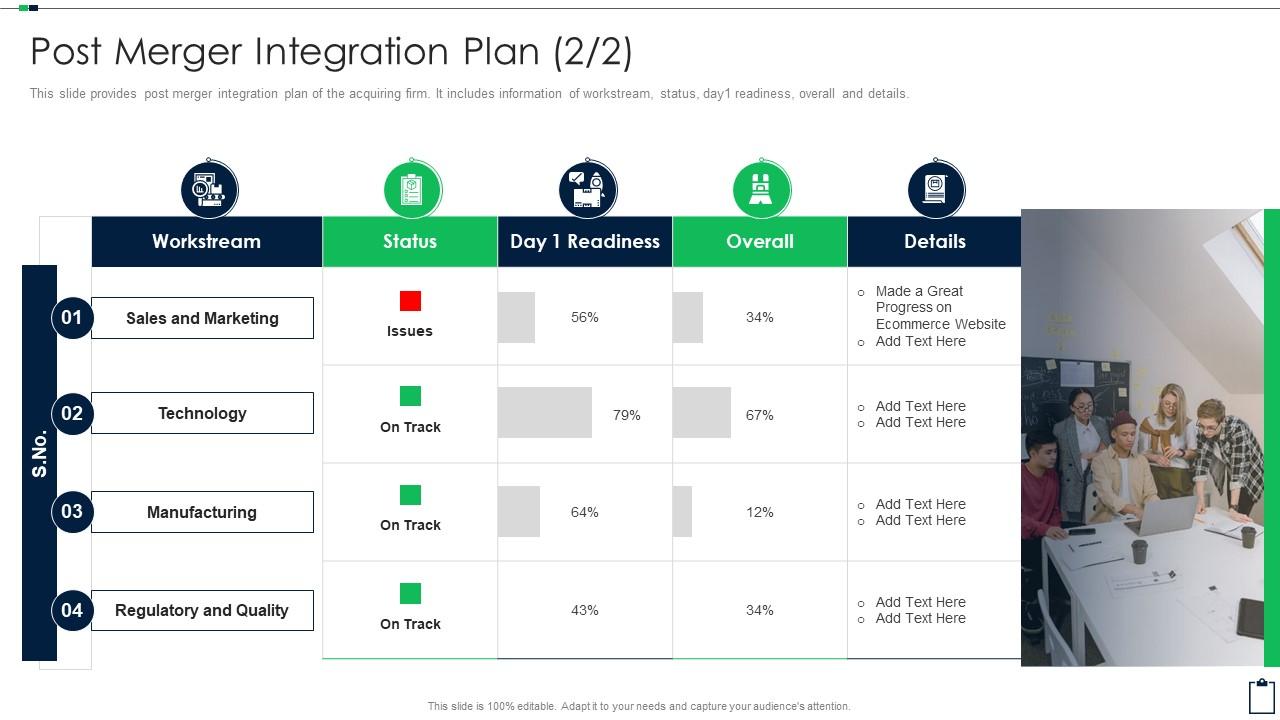

Post Merger Integration Plan Template

Post-merger integration is a complex process that comes with its own set of challenges. Organizations often encounter common hurdles that can impede the seamless integration of data and systems. These challenges include: Data Silos: Merging organizations typically have their own separate data systems and repositories, leading to data silos.

Veralon Checklist Discussing Onboarding Issues Before Closing a Physician Practice Acquisition

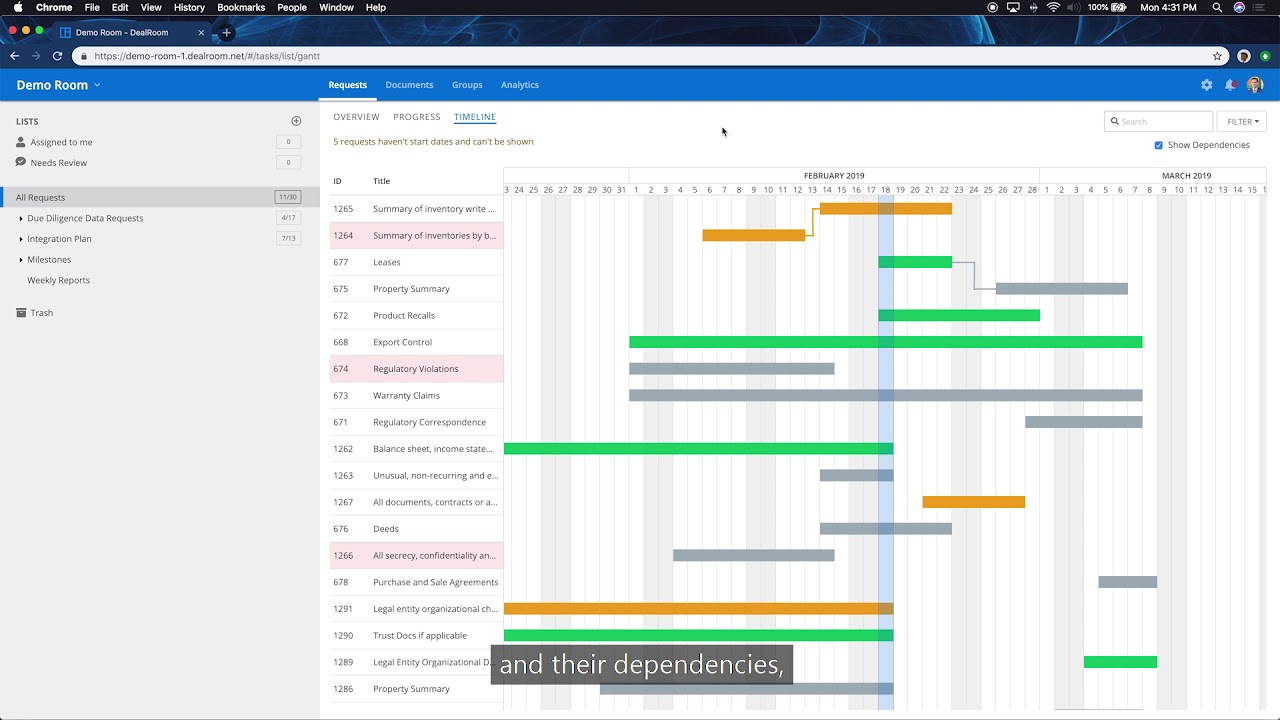

Our post-merger integration plan tools and templates help simplify and expedite integration work and help teams produce it in common formats. The acquisition integration project plan tools and templates are organized in these categories: Planning Reporting Communication HR Governance Charter Culture

Post Merger Integration Checklist Sun Acquisitions Chicago Business Broker and M&A Firm

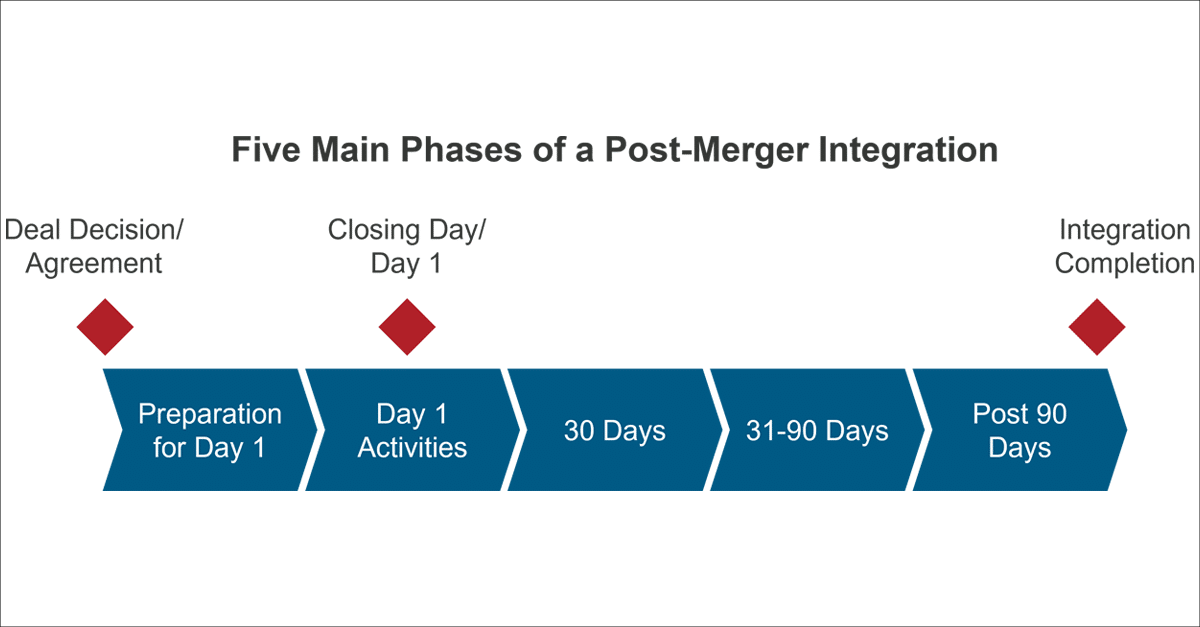

1 Introduction: Document PMI details Enter details for the external advisors Complete the integration due diligence M&A strategy & defining principles: Introduction: This workflow is designed to walk you through every stage of the post-merger integration process from pre-planning to post-mortem.

Information Technology M&A Integration Checklist DealRoom

Post-merger integration checklists for Phase 1: Preparation for Day 1 During the pre-close period, the key focus must be on the crucial tasks necessary for a successful close. These critical tasks generally fall within the Legal, Finance, People (HR) and Marketing & Communication workstreams.

PostMerger Integration Checklist with Examples Burnie Group

We've created a post-merger integration checklist for you—along with some guidance on managing the change. The problem with traditional M&A integration checklists When looking to merge two organizations, you're bound to encounter resistance. This is especially true when each side has its own culture and leadership it wants to protect.

Creating A Merger Integration Checklist Plus A Sample Vrogue

Merger Timeline Template This simple template provides a visual outline for your merger schedule. The timeline separates the phases of a typical merger, with space to list key activities and due dates. You can use this initial schedule throughout the process as a blueprint for your efforts. Download Merger Timeline Template

Acquisition Integration Checklist Template Card Template

Post-Merger Integration 100-Day Plan provides 53 pages of detailed checklists for Due Diligence, HR, IT, Finance, Sales, and Legal. The 100 Day M&A plan example is in xls format.

Post Merger Integration Toolkit Crear presentaciones, Presentaciones, Crear

Post Merger Integration Checklist covers over 110 integration tasks in the areas of synergy tracking, chart of accounts, cash management, accounting policy variances, accounts payable, and accounts receivable. Excerpt from the Excel checklist: Cash Management. Examine whether cash on hand has historically met seasonal needs of the Target:

Post Merger Integration Checklist Ready to Use Template

Four Post-Merger Integration Checklists that cover Information Technology, Human Resources, Finance, and Legal. Sales, Marketing & Operations M&A Due Diligence Checklists - Sales, Marketing, and Operations Free Comprehensive 95-page sales, marketing, and operation guide to conduct thorough, effective M&A due diligence.

Wavestone IT Mergers & Acquisitions

In fact, we've created an entire post-merger integration checklist to ensure your transaction lives up to your expectations and propels the new business forward. And we're going to backstop our checklist with insights on essential topics like: The benefits of using a PMI checklist Defining post-merger integration The roles and activities involved

Acquisition Due Diligence Checklist Post Merger Integration Plan Presentation Graphics

Review list for consolidation opportunities Identify software / application requirements to align between organizations (e.g., financial, CRM, ERP, Email, etc.) Develop migration plan for alignment Identify any software currently in development or planned. - Determine status of development activities (progress, % complete, money committed.

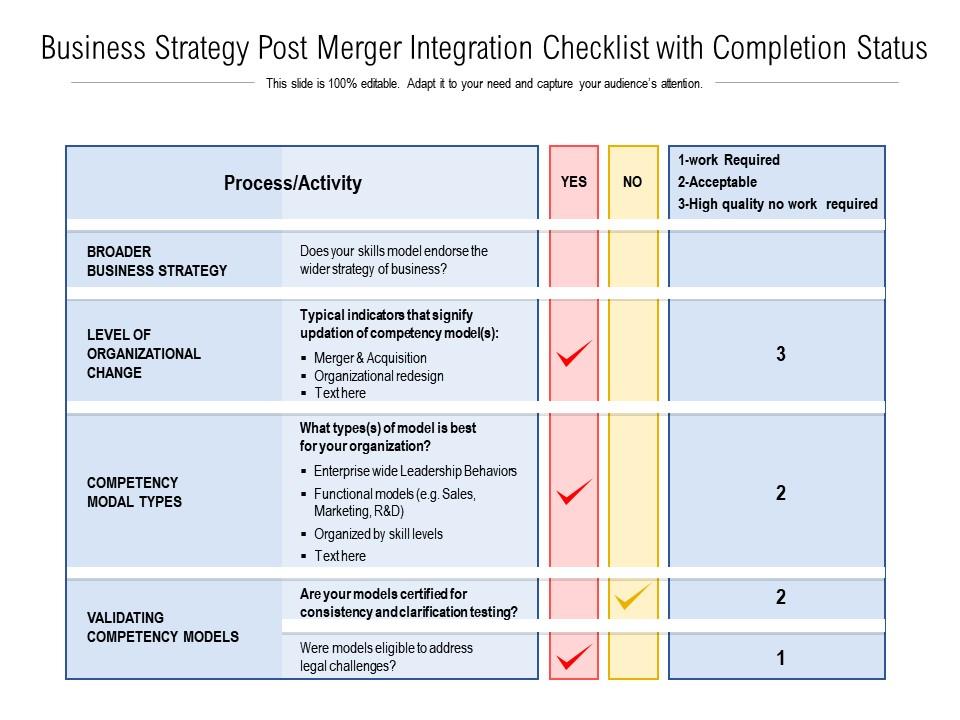

Competency Checklist Template

Incorporating an effective post-merger integration checklist is essential for seamless M&A transitions and this comprehensive guide provides you with the insights you need and a free template checklist for successful merger and acquisition integrations across various areas. Get Your Free OCM Account and Access Free M&A Integration Resources

Business Strategy Post Merger Integration Checklist With Completion Status Presentation

We can identify a few critical steps for a successful integration strategy keeping value, direction, and structure in mind. 1. Start early. As a rule, mergers and acquisitions are highly time-sensitive operations, so you should do your best to start the integration process as soon as the deal is set.

Post Merger Integration Plan Template

An integrated approach to technology can help the combined organization track and prioritize new and existing critical risks with advanced, connected platforms. This collection of post-merger integration checklists can help CROs: Evaluate the health of the risk program. Assess new leadership and investments. Review the business continuity plan.